Contents

Bank of Baroda Personal Loan

The Bank of Baroda provide personal loan to the existing clients and even customer of other Banks. The Bank of Baroda is government owned Bank. The BOB personal loan is unsecured personal loan. The Loan amount can be used for personal expenses. You can spend Bank of Baroda PL loan amount to complete your urgent financial needs.

You can use BOB personal loan amount for personal expenses like wedding expenses, travelling expenses, urgent health spending and many more. You should avoid to use PL amount in risky investment ideas like Stock market, Cryptocurrency and Ponzi schemes. You can use Bank of Baroda personal loan amount to clear high interest rate personal loan.

The Bank of Baroda offer personal loan for the maximum period of 5 years. The Bank also offer covid 19 personal loan support for the existing clients. The Bank of Baroda customer should apply for personal loan as it is provided at low interest rate.

BOB Personal Loan

BOB Personal Loan Amount

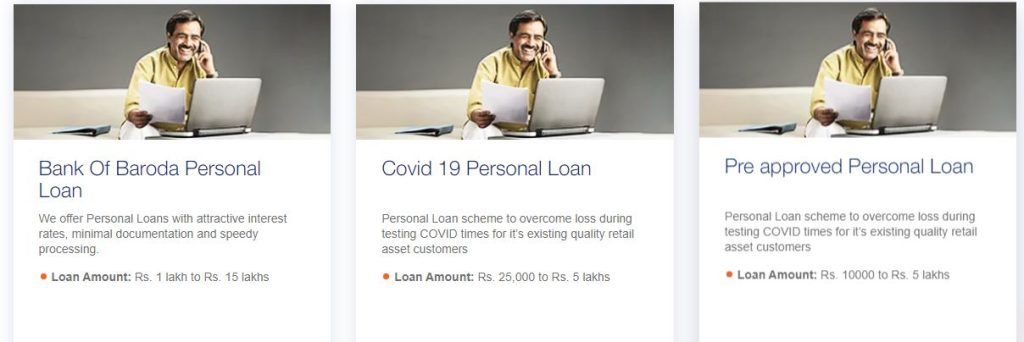

The customer can get personal loan up to Rs 15 Lakhs. Based on your loan application and documents you can get Rs 10000 to 1500000. Remember, Personal loan amount depend on your Income tax return, Salary slip. The Bank of Baroda offer 3 type of Personal loan to the customer.

- The Bank of Baroda offer Personal loan amount : Rs. 1 lakh to Rs. 15 lakhs based on your provided loan documents.

- BOB Covid 19 Personal Loan amount : Rs. 25,000 to Rs. 5 lakhs

- BOB pre approved Personal Loan Amount : Rs. 10000 to Rs. 5 lakhs

How to apply for Bank of Baroda PL online?

The Bank of Baroda customer can visit Bank of Baroda’s branch to get Personal loan. You can apply for Bank of Baroda personal loan via online website also. The online application is too easy to submit. The salaried and Business owner/ Self employed can apply Bank of Baroda PL online.

You can apply online for BOB Personal loan with below listed steps,

- Go to official website of Bank of Baroda

- Then on the Homepage click on Loan

- Now click on Personal loan option under Loan

- You can see Apply Now button under personal loan & Pre approved Personal loan Tab

- You will directed to online application page

- Now if you are salaried person then click on salaried and then Proceed

- If you are Business owner or Self employed then select For self employed and then Proceed

- In the next step, Enter your Mobile and verify your Mobile Number

- Follow the process and complete your Bank of Baroda Personal loan application

Bank of Baroda Personal Loan

BOB PL Interest Rate

As we discussed Bank of Baroda provide personal loan at attractive interest rate. Remember, You should avoid personal loan from unverified loan application. They provide personal loan at unrealistic interest rate. The interest rate depends on your credit history, salary slip and many parameters.

Remember, This personal loan is unsecured loan, so you don’t need to provide collateral to Bank of Baroda. The Bank provide Lowest interest rate 10.5% For Existing Customers having account Relationship with our Bank for minimum -6- months. The Bank of Baroda provide Lowest Interest rate 12.5% to applicants having account relationship with other Bank for minimum -6- months.

Remember This is only lowest rate of Interest rate offered by Bank of Baroda. The final Personal loan Interest rate depends on your loan application, credit score and many more parameters. So you should ask for final Interest rate on your personal loan application, you can ask for lower rate of Interest on your loan application.

Also Read, Bank of Baroda Balance check number

Benefits of BOB PL

The customer can avail PL without any collateral. You don’t need to offer any security amount, assets, guarantor for your Personal loan. It is also used as emergency fund provided. It gives advantage over loan offered in credit card. You can avoid high interest rate of credit card.

You can pay your loan EMI via cheque, from BOB account and even Net Banking. You can pay loan EMI via many UPI application also. The Bank offer flexibility in usage of fund.

Who can apply BOB personal Loan?

The salaried person and Business owner both can apply for BOB PL. If you are salaried person in Government organization, then you can easily get loan against your salary slip. If you are working with Private organization, then you need to submit salary slip and should have more than continues service of one year.

Remember, for the Self employed person, the loan parameters were changed. If you are business owner then you can get loan against your business statement. The Business owner must have stable business to get personal loan. The minimum age of Applicant should be 21 years for salaried and business owner. The co applicants are not allowed in PL application. The Maximum age for salaried person is 60 years & 65 years for Business owner.

If you are Insurance agent then your business period should be more than 2 years. The Self-employed professionals should have stable business with minimum 1 year of experience. The professional can be Engineer, Doctor, Architect, Interiror designer, web developer, C.A. and many more. Non resident Indian can’t apply for Personal loan in Bank of Baroda. Even Bank of Baroda staff can’t get personal loan as they provide better option for Bank of Baroda employee.

Documents needed for Bank of Baroda Personal Loan

You can apply for Bank of Baroda personal loan online and offline. Remember, you need to submit your loan application with proper documents to the Bank. You should fill Bank of Baroda personal loan application. You need to provide 3 passport size photographs with the application.

Below are listed documents for Bank of Baroda Personal loan application, please refer it.

- Identification Document : You can use PAN card, Aadhar Card, Driving license, Passport, Voter ID card and Other ID documents

- Resident Proof : You need to submit one Resident proof with your loan application. The Resident proof can be Driving license, Voter ID, Aadhar card, Electricity bill, Ration card, Bank passbook, Rent contract and other legal Resident proof document

- For Salaried Person : Last 3 Months salary slip and Bank statement of Last 6 months

- For Business owner/ Self employed Person : Balance sheet and Profit and Loss statement of last 1 year. Income Tax return of last one year or 26 AS or Traces. You need to provide Business proof if you are Business owner.

- For Working professional : You need to provide IT Assessment/Clearance Certificate, Income Tax Challans/TDS Certificate (Form 16A)/Form 26 AS for income declared in ITR

Also Read, Bank of Baroda RTGS form PDF

Bank of Baroda Personal Loan Covid 19

The Bank of Baroda personal loan provided for financial help during Covid 19 period. The customer can get personal loan of minimum Rs 25000 in Bank of Baroda Personal loan for Covid 19 period. The maximum amount can be Rs 5 lakh. The loan is offered to existing loan customer of Bank of Baroda. You can top up your Bank of Baroda Auto loan, Home loan, car loan in Bank of Baroda.

The Maximum loan period can be 60 months in BOB Covid 19 loan. The prepayment charges for BOB Covid 19 personal loan is zero. The Interest rate for Bank of Baroda Personal loan (Covid 19) is BRLLR + SP+ 2.75% per annum with monthly rest. The ROI is irrespective of credit Bureau score for PL interest rate.

BOB Pre approved Personal Loan

The Bank of Baroda also provide pre approved loan to the existing clients. You can avail BOB pre approved personal loan via online method. The pre approved loan can be applied via official website i.e. bankofbaroda.in.

The Bank of Baroda personal loan (pre approved) offered to salaried and business owner both. The Salaried person can get PL by providing Aadhar Card, Pan card, Digital bank statement of 12 years. You need to login via your BOB net Banking credential to apply for Pre approved Bank of Baroda personal loan. You need to provide resident proof to get pre approved BOB PL.

Remember, If you are applying for online Personal loan then you should perform KYC online. You need to provide web camera permission to submit your photo in digital bank of Baroda personal loan.

The Self employed person can upload their GST details in online Personal loan application. You need to submit PAN Card details and Aadhar card details here. You can submit your Income tax return of last 2 year here.

Conclusion

The Bank of Baroda personal loan provided to customer online and offline method. The Personal loan amount depend on location of customer. The metro customer of Bank of Baroda can get loan up to 15 lakhs. The semi urban and rural customer can get Bank of Baroda personal loan from Rs 50000 to Rs 15 Lakhs.

The Bank of Baroda customer can get financial help without any collarette in BOB PL. The customer are requested to apply for Bank of Baroda personal loan from official website. You should avoid to get help from inter mediatory person.

We are not affiliate with Bank of Baroda. Dear readers, this article provided for the information regarding Bank of Baroda personal loan. You must consult Bank of Baroda employee for your personal loan application or information. You can refer Bank of Baroda website for more information.

What is processing charge for Bank of Baroda personal loan?

The customer need to pay processing charges for personal loans in Bank of Baroda PL application. Your processing fee calculated as 2% + GST of the loan amount, with a minimum of Rs. 1000 + GST up to Rs. 10,000 + GST in Bank of Baroda.

Can I get Personal Loan via BOB world app?

Yes, Customer can get personal loan via BOB world app. You can get pre approved Personal loan and Micro loan in BOB world Mobile application. You can get personal loan up to Rs 15 lakhs depend on your eligibility.