Contents

Latest ICICI Bank RTGS Form PDF

If you are searching for ICICI Bank RTGS form or ICICI Bank NEFT form then you are at right place. Remember ICICI Bank RTGS form is useful for your RTGS Transaction in ICICI Bank account. With help of ICICI RTGS form you can transfer amount more than Rs 2 Lakh to any bank account.

ICICI is second biggest Private Bank in India. The progress of ICICI bank in recent time increased positively. The ICICI Bank provide one of best Android Application to the customer. The application comes with UPI payment integration also. The ICICI Bank was founded in 1994. The Bank’s headquarter is situated in Mumbai, Maharashtra, India.

Our website also published ICICI Bank NEFT form PDF. The ICICI bank NEFT Form is useful to do NEFT transaction in ICICI Bank anytime. The amount less then Rs 2 lakh should be remitted via ICICI Bank’s NEFT form.

Type : PDF

Usage : NEFT and RTGS transaction in ICICI Bank

Source : ICICI Bank website

Bank’s official Website : https://www.icicibank.com

Information Updated on : 22 February 2023

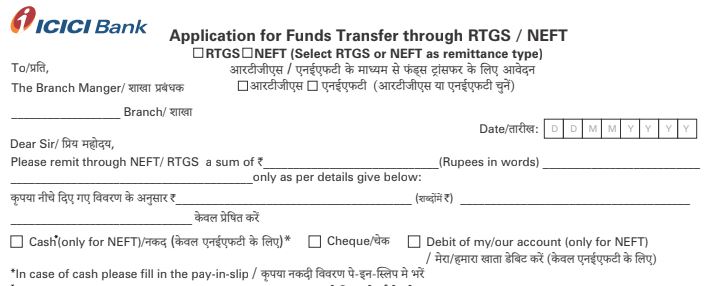

If you wanted to see preview of ICICI bank RTGS form or ICICI Bank NEFT form PDF then below image is attached.

Preview ICICI Bank RTGS form

See upper image of ICICI NEFT Form /ICICI RTGS form, the form require detailed information from remitter. in this article we ill se how to fill ICICI bank’s RTGS form also. The same guideline applies to NEFT form also.

Also read, ICICI Bank POSDEC Charges 2023

ICICI Bank NEFT Form PDF

You can download ICICI Bank NEFT / RTGS Form PDF from our website Insuregrams. The ICICI Bank’s NEFT transactions settled in Batch of NEFT transactions. To complete ICICI NEFT Transaction you need Beneficiary details and IFSC of the beneficiary bank branch. The RTGS system, Originating and destination bank branches are part of the RBI’s RTGS network. Below is link to avail your download

The ICICI Bank RTGS form will be useful if the Transaction amount is more than Rs 2 Lakh. If the Transaction value is less than Rs 2 Lakh than customer need to use ICICI NEFT Form. The customer can use IMPS or UPI service of ICICI Bank as per convenience.

The RTGS and NEFT service is not available at each bank. Many corporate Bank use other Bank’s RTGS facility to complete their Transaction. According to RBI, ICICI Bank’s each branch has facility of RTGS and NEFT Transaction. The ICICI RTGS facility is also useful in Third party transactions. ICICI Bank’s RTGS and NEFT is more reliable, Secure payment gateway for Electronic transaction i.e. third party transactions.

If you are using cash for ICICI Bank NEFT transaction then you need to use ICICI Bank’s deposit slip. You can get this Slip by clicking here.

ICICI Bank NEFT FORM

What is time for ICICI bank NEFT and RTGS?

The ICICI RTGS and NEFT facility is available in mobile banking, Internet banking also. Customer can use ICICI NEFT / RTGS facility without visiting bank. As per RBI guidelines, National Electronic Funds Transfer (NEFT) is available 24×7 with effect from Dec 16, 2019.

Note: The service of NEFT and RTGS at ICICI Bank branch available only during working hours.

In ICICI Bank RTGS time is shown in table,

| On Working week days Monday to Friday RTGS | 8.00AM to 3:30PM |

| On Working Saturdays RTGS | 8.00AM to 3.30PM |

| On Sundays and Public Holidays RTGS | No Transaction Allowed |

In ICICI Bank For RTGS can done even in mobile application. Saturday ( excluding 2nd and 4th ) : Branch working hours. Monday to Friday Normal working hours. Sunday is holiday for ICICI bank’s RTGS, NEFT transactions.

What are charges for ICICI Bank RTGS and NEFT?

The charges for NEFT and RTGS in ICICI bank are shown in table.

Note: All transactions initiated through eBanking are free and no additional charges are imposed in ICICI Bank.

| Amount of RTGS | Transaction Service Charges (Exclusive of GST) |

| Rs.2 lakhs & up to Rs.5 lakhs | Rs 20 |

| Above Rs.5 lakhs | Rs 45 |

| Amount of NEFT | Transaction Service Charges (Exclusive of GST) |

| Up to Rs.10,000/- | Rs. 2.35 |

| Rs.10,001 and up to Rs.1 lakh | Rs 4.75 |

| Rs 100001 to Rs 200000 | Rs 14.75 |

| Rs 200000 | Rs 24.75 |

Download ICICI Bank NEFT RTGS FORM

Conclusion

The ICICI Bank RTGS and NEFT service available at Branch. The customer can use Net Banking and Mobile Application for financial Transactions. The PNB customer can transact more than Rs 2 lakh with the help of ICICI RTGS form. For less than Rs 2 Lakh, the customer can use ICICI NEFT service.

As we know, The ICICI Bank is also available on UPI network. The customer of ICICI Bank can use UPI applications for small amount of transactions.

How To Fill ICICI Bank RTGS and NEFT Form?

Fill General Details

As you see in image, you need to enter date, Branch Name in ICICI Bank’s RTGS and NEFT form. The form is useful for both NEFT & RTGS. Then enter amount, amount in words. You can use cash for NEFT purpose but you need to give cheque for ICICI Bank’s RTGS Transaction. You need to tick between Cash, cheque, debit from account option.

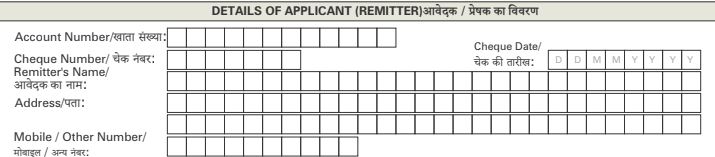

Fill Details of Applicant

Now in next section fill details of your. You need to enter your account number, cheque number. Then fill cheque date and your address, your name. Then enter your mobile number.

Enter details of Beneficiary

In next section, you need to enter details of the beneficiary. Now enter beneficiary name, account number of Beneficiary, Bank name, IFSC Code. Then enter Branch address and again write account number for confirmation. You can add your remark in ICICI Bank RTGS / NEFT form.

Customer signature

In next section, you need to sign for your ICICI RTGS NEFT Transaction. If there is any account joint holder then there is other section for joint applicant.

Customer Acknowledgement

The next section is for Bank usage. When you submit your ICICI Bank’s RTGS or NEFT form. They will return customer acknowledgement part with sign and stamp of Bank. In Forum you can enter purpose code for your ICICI RTGS Transaction.

What is maximum and minimum limit for ICICI RTGS Service?

The ICICI Bank offer RTGS service for transaction value more than Rs 2 Lakhs. So ICICI Bank’s minimum limit for RTGS is Rs 2 Lakh. While there is no maximum limit for RTGS Transaction. Still we request customer to intimate Branch Manager if RTGS Account is more than 1 Crore.

What is maximum and minimum limit for ICICI NEFT Service?

There is no limit for ICICI Bank’s NEFT service. You can transfer any amount you want in ICICI NEFT service. You can pay your credit card payment with NEFT service also.

There is no limit for ICICI Bank's NEFT service. You can transfer any amount you want in ICICI NEFT service. You can pay your credit card payment with NEFT service also.

" } } ] }