Contents

Bank of Maharashtra RTGS NEFT Form PDF Download 2023

If you are finding Bank of Maharashtra RTGS NEFT form then download from below any link. BOM bank RTGS form is used to do RTGS in Bank of Maharashtra. In RTGS Amount more than 2 Lakh Rs can be transferred to any bank account. Bank of Maharashtra Bank NEFT Form is used to do NEFT in Bank. There is no minimum amount limit for NEFT in Bank of Maharashtra.

Bank of Maharashtra (BOM) Bank provide personal Banking Facilities such as Accounts, Term Deposits, loan, gift Cards, credit cards and many more. Active in NRI, Agriculture, Corporate Banking segment as well as.

The official website of BOM Bank is https://www.bankofmaharashtra.in

Also Read, Axis Bank RTGS Form PDF

How to download BOM NEFT And RTGS Form PDF?

You can download Bank of Maharashtra RTGS Form PDF from Insuregrams. Also You can download NEFT Form PDF from only and only Insuregrams. You can Use this RTGS/NEFT Form after downloading from our website.

RTGS and NEFT is electronic payment gateway used by Banks for more secure transactions. RTGS is for real time settlement process. While NEFT done in Banking transaction Batches. RTGS stands for Real Time Gross settlement. NEFT stands for National Electronic Fund Transfer system. RTGS and NEFT is more reliable, Secure payment gateway for Electronic transaction.

Bank of Maharashtra RTGS NEFT Form Download

In RTGS system, Originating and destination bank branches are part of the RTGS network. IN RTGS and NEFT, Beneficiary details such as beneficiary name, account number and account type, name and IFSC of the beneficiary bank branch should be available with the remitter.

Also read, Axis Bank NEFT form PDF

What is time for Bank of Maharashtra RTGS and NEFT?

Note: The service of NEFT and RTGS at Bank branch available only during working hours.

NEFT transactions will be available 24*7 for online transactions such as internet banking, mobile banking

For RTGS time is shown in table,

| On Working week days Monday to Friday RTGS | 08.00 AM to 4.30 PM |

| On Working Saturdays RTGS | 08.00 AM to 4.30 PM |

| On Sundays and Public Holidays RTGS | No Transaction Allowed |

NEFT facility will not be available on 2nd and 4th Saturdays of the month.

For NEFT time is shown in table,

| On Working week days Monday to Friday NEFT | 08.00 AM to 07.00 PM |

| On Working Saturdays NEFT | 08.00 AM to 07.00 PM |

| On Sundays and Public Holidays NEFT | No Transaction Allowed |

NEFT facility will not be available on 2nd and 4th Saturdays of the month.

If you have issue in RTGS Transaction in Bank of Maharashtra then kindly contact

For NEFT complaints : bomneft@mahabank.co.in

For RTGS complaints : cmrtgs@mahabank.co.in

Email Id of RTGS cell: cmrtgs@mahabank.co.in

Customer Care for NEFT : 022-22780325

Customer Care for RTGS: 022-22780324

If the issue of NEFT/RTGS is not resolved satisfactorily, the Customer Service Department of RBI may be contacted at –

The Chief General Manager,

Reserve Bank of India,

Customer Service Department,

1st Floor, Amar Building, Fort,

Mumbai-400001

Download Bank of Maharashtra neft RTGS FORM

Also Get, SBI Deposit Slip PDF

How To Fill Bank of Maharashtra RTGS and NEFT Form?

Remember RTGS is used for amount more than 2 lakh Rs. While NEFT is used for amount less than 2 lakh Rs. Here are steps for how to fill RTGS and NEFT form.

- Amount to be remitted: Write exact amount which should be remitted from your account

- The account number to be debited: Your Bank of Maharashtra account Number from which the transaction amount will be debited.

- Name of the beneficiary bank and branch: Write clearly beneficiary of your transaction and branch code of beneficiary.

- The IFSC number of the receiving branch: IFSC code is important in RTGS and NEFT. Please write it in form

- Name of the beneficiary customer: Customer Name without any mistake

- Account number of the beneficiary customer: Never mistake in account number. write it carefully.

- Sender to receiver information, if any required. For tax purpose you can write it.

Download Bank of Maharashtra RTGS NEFT FORM

What are charges for Bank of Maharashtra NEFT/RTGS?

The charges for Bank of Maharashtra NEFT/RTGS are shown in below table.

Note: All transactions initiated through e-Banking are free and no additional charges are imposed in Bank.*Confirm First with branch Staff

NEFT Inward Charge is Zero in Bank of Maharashtra.

RTGS Inward Charge is Zero in Bank of Maharashtra.

| Amount of RTGS | Transaction Service Charges (Exclusive of GST) |

| Rs.2 lakhs & up to Rs.5 lakhs | Rs 25 (9 to 12 HRS) |

| Rs 26 (12:01 to 15:30 HRS) | |

| Rs 30 (15:31 onwards) | |

| Above Rs.5 lakhs | Rs 50 |

| Rs 51 (12:01 to 15:30 HRS) | |

| Amount of NEFT | Transaction Service Charges (Exclusive of GST) |

| Up to Rs.10,000/- | NIL |

| Rs.10,001 and up to Rs.1 lakh | NIL |

| Rs 100001 to Rs 200000 | Rs 15 |

| Rs 200000 | Rs 25 |

FAQ

Q-1 Is there any upper limit for RTGS transactions in Bank?

Ans 1: RTGS transaction in bank of Maharashtra is only used for large value transactions. There is only ceiling limit (Minimum Value) of Rs 2 lakh Only. There is no upper limit for higher transactions. If amount is extreme big then talk with Branch Manager for smooth operation.

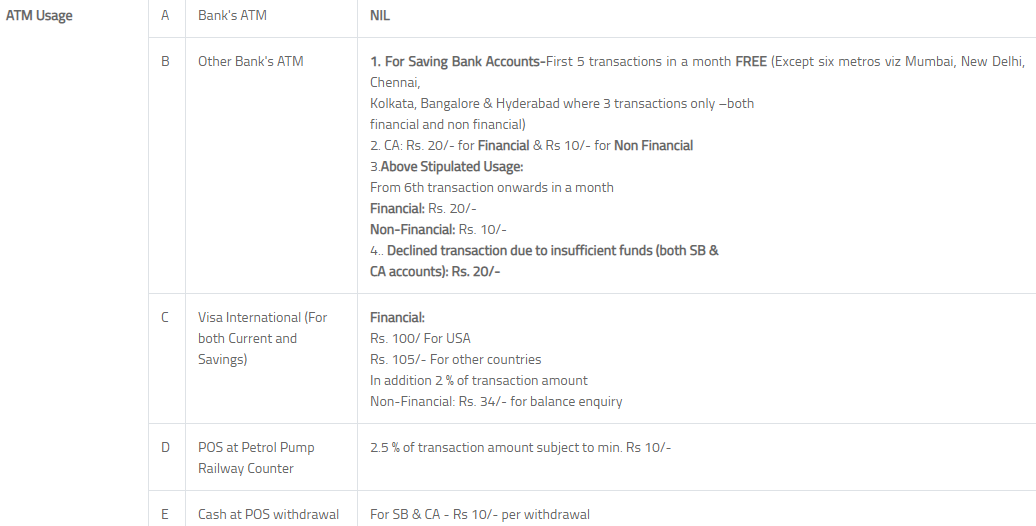

Q-2 What is ATM usage charge in Bank of Maharashtra?

Ans 2: Bank of Maharashtra customer can use their ATM 5 times without any cost. For Saving Bank Accounts customer First 5 transactions in a month. The six metros (Mumbai, New Delhi, Chennai, Kolkata, Bangalore & Hyderabad) customer get 3 transactions only –both financial and non financial transaction.

For current account holder Bank of Maharashtra Debit Card Usage charge is Rs 20 for Financial Transaction & Rs 10 for nonfinancial Transaction. Other Charges shown in Image.

ATM charge in Bank of Maharashtra

Service Charge Link: Click here

Conclusion

The Bank of Maharashtra RTGS form useful in making large amount of transactions. For small amount’s transaction you can use UPI facility of the Bank. You can download UPI apps like Paytm, Gpay, PhonePe or other application to make your small amount transaction.

The Bank of Maharashtra RTGS Form PDF is available on our website. You can download and use Bank of Maharashtra RTGS form for your financial transaction.

Comments are closed.